Four reasons why neobanks should adopt crypto services

The neobanks industry is worth roughly $300 billion, and serves nearly one billion customers worldwide.1 Skyrocketing popularity means these digital banking models are both growing and proliferating rapidly. 78% of US adults now prefer to bank online2, and one particularly revealing 2023 study shows 30% growth in neobank clients over eighteen months — with a 43% increase in revenue across the same period.3 It’s clear that the industry is rife with opportunity.

Yet despite this solid foundation, only 5% of these digital banking companies are profitable.4

So what opportunities are neobanks exploring to increase their revenue and profitability numbers? Let’s first look at some of the major challenges contributing to slow growth.

The neobanks market is highly competitive. There has been a laser-tight focus on expansion that pushed financial metrics like net income to the wayside. While this growth-first strategy allowed neobanks to achieve a projected CAGR of 47.3% from 2023 to 20325, it’s also contributed to underwhelming revenue growth. Given how quickly the industry is evolving, neobanks should act strategically to maintain cutting-edge value propositions and future-proof their services.

The most future-focused of the bunch are doing just that, embracing innovative tactics that offer new revenue streams and more engaged audiences. There are a few trends contributing to recent revenue growth in the space. Some companies are leveraging the power of AI to offer their customers more personalized experiences, while others are offering instant loans and credit approvals.

Neobanks are well-positioned to capitalize on their popularity and encourage continued growth by integrating cryptocurrency services into their platforms. Traditional banks have been slow to adopt crypto, leaving a gap in the market that neobanks can and should take advantage of. We will explore four key areas where adoption of digital assets can aid neobanks on the road to widespread profitability.

1. Crypto services generate new revenue streams

Given how thin the profit margins are for many neobanks, the extra sources of revenue provided by integrating crypto can be a welcome boon. Currently, most neobanks earn income from two main sources: interchange fees paid by the merchant’s bank after each debit transaction, and interest on deposits held in customer accounts.

Providing crypto services opens the door to alternative revenue streams, including funds stemming from transaction fees (levied per trade) and spread revenue. 81% of crypto owners are interested in buying cryptocurrency directly through their banks, and 35% of crypto owners, intend to switch to a bank offering crypto investment options within the next year.6 You want these customers conducting their financial activities —whether crypto or fiat — on your platform.

Learn more about Bakkt's turnkey crypto trading offering for Neobanks >

2. Offering crypto trading can drive customer acquisition and retention

Recent studies show crypto ownership rates at as high as 40% among US adults.7 Of that group, 63% have expressed their intent to acquire more crypto within the next year.8

Recent studies show crypto ownership rates at as high as 40% among US adults.7 Of that group, 63% have expressed their intent to acquire more crypto within the next year.8

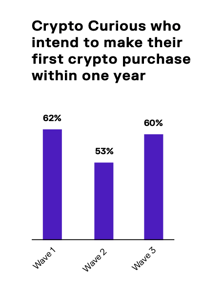

Similarly, 60% of people who have not yet purchased crypto — but intend to — say they are likely to make their first purchase within the next year.9 That’s a high level of consumer purchase intention, and it will undoubtedly be capitalized on by profit-hungry businesses; it’s just a matter of who is able to capture audience interest first.

Expanding product offerings through the adoption of crypto services can help neobanks further differentiate themselves from traditional banking models, lowering customer elasticity and subsequently increasing revenue. The fact that 40% of consumers state their willingness to open an account with a neobank shows a high degree of fluidity and receptiveness in the market; the latent acquisition potential is there.

And in the case of retaining existing customers, even a 5% increase in retention rates can lead to an over 25% increase in profit.10 Aside from drawing in digital asset aficionados, crypto also helps neobanks appeal to those who are looking for a way to make faster, cost-effective cross-border payments. Unique Selling Propositions (USPs) such as this can have a big impact on brand reputation and market share.

Currently, 40 to 60% of neobank customers utilize neobanks as their primary financial institution.11 Since a large portion of crypto users (76%, according to Bakkt research) trust their primary bank as a venue for accessing crypto, bringing more crypto users into the fold could be key to lowering turnover rates and creating long-lasting brand affinity.

3. Crypto trading can increase neobank platform engagement

Evolving consumer expectations are raising the bar for neobanks and their competitors. Integrating crypto services into neo-banking apps means customers can hold all their digital assets in the same place as their fiat currencies — a vital capability as consumers increasingly advocate for more holistic financial ecosystems. Eliminating the need for a separate crypto wallet has the potential to increase engagement by encouraging customers to carry out all of their banking activities on a single platform: yours.

By embracing crypto, neobanks can boost the number of incentives a customer has for interacting with your ecosystem on a regular basis, thus increasing the frequency of their visits and “stickiness”. Satisfied users are also more likely to refer your platform to their friends and family.

The unification of services also allows brands to easily consolidate data and gain valuable consumer insights that can be used to tailor future offerings. This in turn becomes another useful avenue for fostering brand affinity, as 70% of consumers would like their bank to use their personal data to create personalized experiences.12

4. Incorporating crypto modernizes your neobank’s reputation with diversified services

Neobank customers and crypto owners are both disproportionately youthful audience segments. A whopping 94% of crypto purchasers are either Millennial or Gen Z13, and 69% of Gen Zs are interested in opening a neobank account.14 The overlap in demographics reveals the profit potential of bundling services and allowing these young consumers to seamlessly move between activities, whether it be purchasing bitcoin or depositing into their digital checking account.

Since many neobanks are not yet crypto-native, adopting crypto services also helps double down on a forward-thinking and innovative brand image that competitors who only offer fiat can’t compete with. 42% of crypto owners say their biggest motivator for purchasing crypto is to take part in “the financial way of the future”15 — a sentiment that aligns well with the stated mission of many neobanks. Staying ahead of the curve is crucial in such a rapidly-evolving space. Neobanks who become early adopters of digital assets will have a significant leg up in a few years, once crypto capabilities have become cemented as an industry standard.

How can neobanks integrate crypto?

Neobanks can reap the benefits listed above by working with a crypto service provider that integrates with their platform via APIs. This enables your customers to buy, sell, and hold crypto without ever leaving the neobank’s platform. So how do you know which crypto service provider is the best fit for your platform?

Look for secure, regulated crypto providers that offer full-stack APIs and can take care of all the heavy lifting behind the scenes—including customer onboarding, KYC authentication, custody, and even tax services. These providers will also ensure your business is covered from a regulatory standpoint. The best providers will have the appropriate licensing and compliance in place.

With deep, reliable liquidity and multiple funding options, Bakkt Trade allows seamless end-to-end crypto trading for neobanks. Rapid price-matching and best price execution minimize costs and ensures your customers receive the best value. Our consistent liquidity also significantly reduces administrative overhead, operational expenses, and transaction fees—plus optimizes cash flow and reduces the need for large liquidity buffers.

Bakkt Trade’s onboarding process can be completed in as little as 45 days, so your neobank can start delivering crypto to your customers as quickly as possible — and crucially, before your competitors. Comprehensive KYC/AML processes ensure your organization remains compliant, and Bakkt provides hands-on support at every step of the process. On/offramp support for fiat is also an option for neobanks who need a provider to handle the process of converting funds.

Bakkt Trade provides access to a huge pool of potential customers, and has licenses to operate across all 50 states.

Staying ahead of competition through crypto adoption

Integrating crypto services into your suite of offerings fosters increased engagement. It unlocks cross-promotion opportunities, enabling you to showcase crypto-related opportunities to existing fiat customers, and vice versa. Finally, allowing customers to buy, sell, or transfer crypto on the platform provides you with valuable additions in revenue streams.

As neobanks look for new ways to stand out in today’s crowded marketplace, their adoption of crypto services is likely to increase. When integrating these solutions into your existing ecosystem, it’s crucial to find a provider who can deliver cutting-edge solutions efficiently, while remaining 100% compliant with regulatory statutes. Whether your goal is to attract new customers or simply to increase your revenue streams, Bakkt Trade can help you meet your goals.

Is your neobank looking for a crypto provider?

Reach out to our team today.