Turnkey Crypto Trading

One integration for everything you need to launch licensed crypto trading services to your customers.

Comprehensive licensing. Consistent liquidity.

Bring crypto to your customers with a reliable partner.

With a deep liquidity network, full-stack APIs, and licenses to operate in all 50 states plus select regions internationally, Bakkt takes care of all the heavy lifting to be your all-in-one crypto brokerage solution.

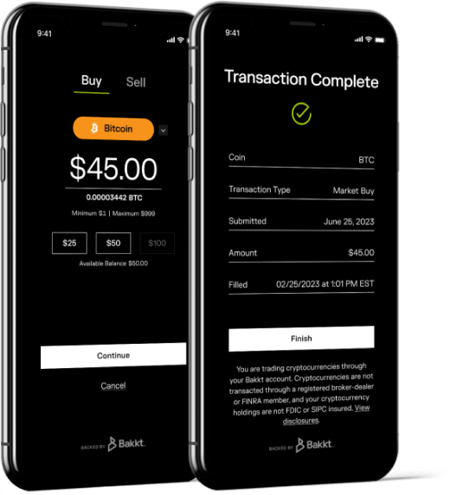

Trade APIs

Utilize our comprehensive suite of APIs to bring secure and reliable crypto trading to your customers quickly. From easy to integrate fiat on and off ramps, enhanced onboarding and KYC/AML processes, and deep and tight liquidity, Bakkt offers everything you need to enable seamless end-to-end crypto trading.

Transforming Crypto Access for All

Whether you’re looking to enter the U.S. market or expand your existing capabilities, Bakkt Brokerage delivers robust liquidity and rapid time to market.

Global Brokers

Your path to simplified U.S. compliance, centralized trading infrastructure, and tailored integrations to ease U.S.-specific operational challenges

Exchanges

Easily expand liquidity access, up regulatory efficiency, and leverage universally applicable settlement infrastructure

Traditional Investment Apps

Seamlessly integrate crypto capabilities alongside your existing offerings while optimizing operations and preserving leadership and trust

Crypto Wallets

Unify trading and custody via API-powered integration, streamlined onramps, and a scalable execution framework

Neobanks

Build unique crypto banking solutions while maintaining the look, feel, and ethos your clients expect

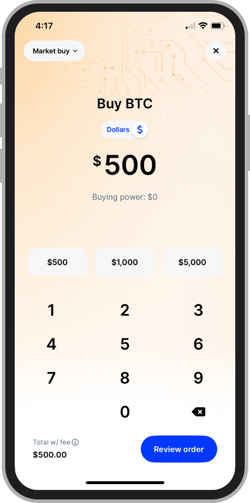

Public leverages Bakkt's full-stack APIs and deep liquidity network to bring crypto trading to millions of users on its investment app.

"We were excited to bring crypto trading to our customers, but knew we had to partner with the right provider to deliver the best experience. Bakkt's APIs, deep liquidity network, and licenses to operate in all 50 states ensured we could provide our customers the opportunity to access crypto trading."

— Stephen Sikes, COO of Public

Interested in Bakkt's crypto brokerage solution?

Bakkt has a proven track record of efficient migrations with millions of users successfully onboarded. If you're interested in how Bakkt can support your business, please provide your information below and a member of our team will be in touch.

FAQ

Bakkt provides hands-on support every step of the way with access to multiple test environments for our clients including sandbox, User Acceptance (UAT), and production. Additionally, we provide 24/7 technical and operational support, and have a dedicated Bakkt marketing center with plenty of resources to help you activate quickly.

Bakkt's brokerage solutions currently supports 42 coins:

AAVE, ALGO, APE, ARB, AVAX, BAT, BTC, BCH, BONK, ADA, TIA*, LINK, COMP, ATOM, CRV, WIF, DOGE, ETH, ETC, FIL, GALA*, HBAR, ICP, LDO, LTC, NEAR, TRUMP*, OP*, PEPE, DOT, POL, PUMP*, XRP, SHIB, SOL, XLM, SUI*, GRT, SAND, TON, UNI, USDC.

*Not currently available for trading in New York state

Bakkt's brokerage solution supports funding for crypto trading through bank accounts via ACH. Funds sent from a bank account will take 3-5 days to post. The platform additionally supports funding via wire transfers, which will post in 1-2 business days.

Bakkt prioritizes compliance, security, and transparency at every level. Clients' crypto funds are held in 1:1 reserves so you know that your customers’ assets are protected. Bakkt’s business continuity plan ensures operational resilience, and our commitment to privacy compliance in the locations we serve protects your customers. For more information on our security measures, check out our Risk & Security page.

Read our latest articles

Bakkt Crypto Solutions, LLC is licensed to engage in virtual currency business activity by the New York State Department of Financial Services.