Fast Facts from Bakkt's Wave 3 Crypto Tracker

The past eighteen months have been nothing if not eventful for the crypto industry. High-profile scandals led to growing demand for a more regulated crypto market. Consumers and institutions alike expect clearer rules with which to navigate the industry. To cap off this era of digital assets, Bakkt is releasing its third and final Crypto Tracker.

The story told in Wave 1, back in October 2022, paints a different picture than Wave 2’s April 2023 data — and the final edition, fielded in November of 2023, provides a glimpse into how sentiments, trends, and market data have continued to evolve since. Before diving into the insights, here’s a look at some of the learnings contained within the report:

Fast Fact 1: Crypto Curious retain their enthusiasm

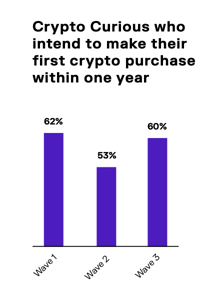

Despite gaps in specific knowledge, interest in cryptocurrency remains robust, particularly among the Crypto Curious*, where only 9% of respondents stated their interest in crypto has waned over the past six months. This demographic continues to ponder entering the crypto market, with many (60%) rating the likelihood of making an initial purchase within the next year as high. This suggests a sustained, long-term interest in buying crypto.

**Study participants who have not yet purchased crypto, but who have expressed interest in doing so in the future

Fast Fact 2: Growing regulatory clarity

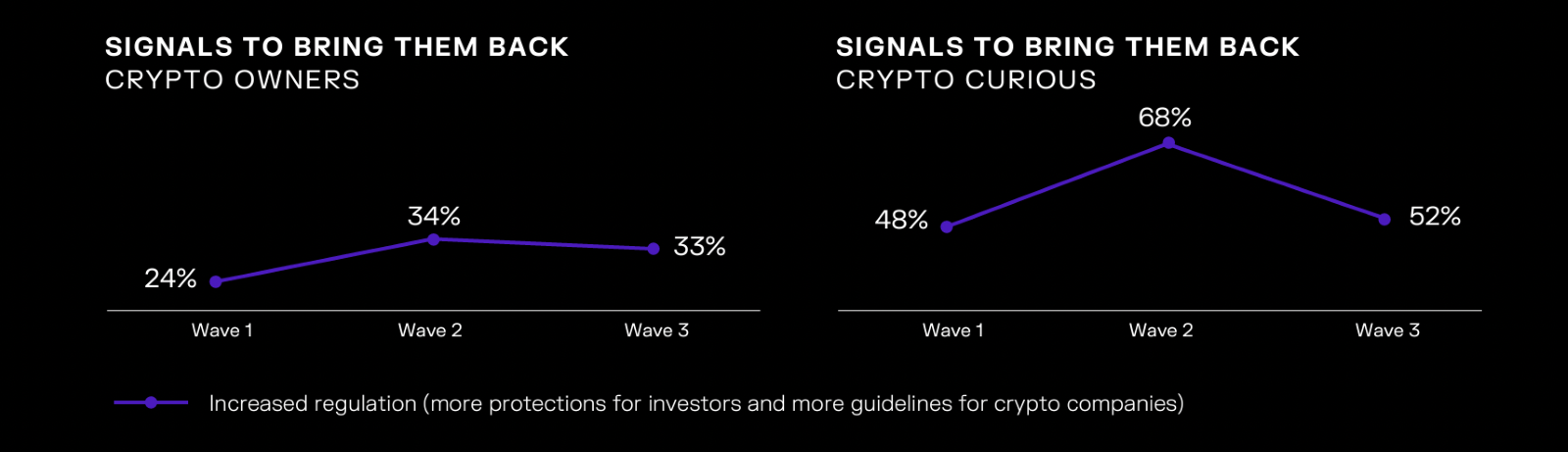

Regulatory frameworks have emerged as a key driver for potential buyers considering entering the crypto space. There's a strong sentiment that robust regulations should precede broader adoption, to ensure a secure purchase environment.

However, at the same time insistence on stringent regulation has decreased from 68% to 52% in Wave 3, reflecting a shift in priorities or perhaps a growing understanding of the market.

Fast Fact 3: Consumers’ evaluations of providers start to shift

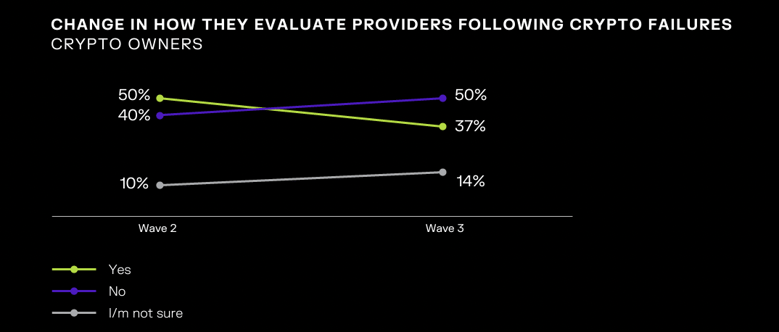

The approach to evaluating crypto service providers has seen a notable shift since Wave 2. While previously 50% of the participants reported changing their assessment criteria in the wake of industry setbacks, this figure has now dropped to 37%. This decline may indicate a growing acceptance of market volatility or a sustained trust in existing providers, suggesting a lower perceived need to alter evaluation standards.

Want more facts from the third installment of our tracker? Download the full report here.