What’s driving crypto’s accelerated growth in Latin America?

Bakkt’s Crypto Current series will delve into the state of crypto in key markets around the world. The below insights shed light on Bakkt’s strategic international expansion efforts, starting with Latin America.

While Latin America is an incredibly diverse region, it remains largely unified in a favorable stance towards crypto. In recent years, the region has developed a reputation for widespread technological investment and has given cryptocurrency a warm welcome. Grassroots adoption is strong, with three countries ranking in the top 20 of Chainalysis’ Global Crypto Adoption Index.1

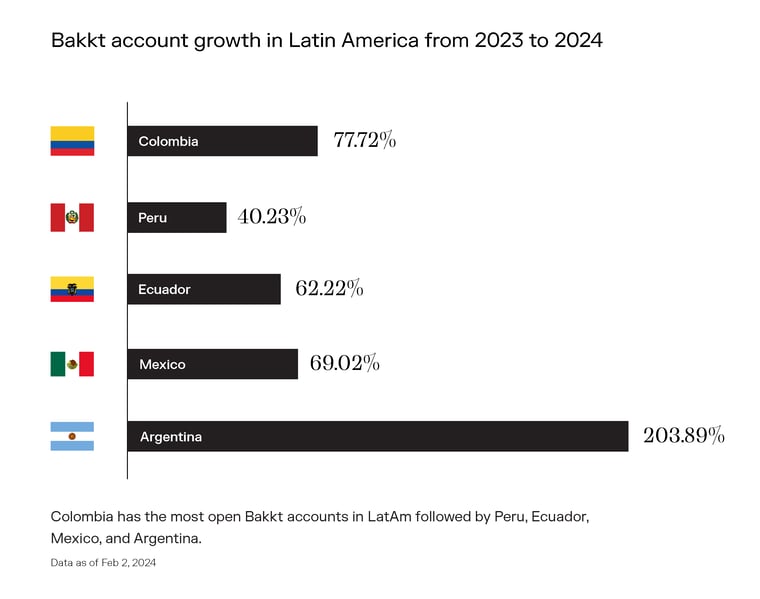

Bakkt has observed a rapid level of growth in the number of crypto trade accounts opened in the region. Since 2022, the number of accounts opened by Bakkt’s client’s users has been accelerating disproportionately compared to other regions. Between 2023 and 2024, the total Bakkt Trade accounts globally grew by 6.69%. Over the same period, the number of accounts in Latin America grew by a whopping 42.76%. Furthermore, while Latin America makes up only 4% of total accounts at Bakkt, it makes up 24% of new accounts opened in 2024*.

So what’s driving Latin America to have the seventh-largest crypto economy?2 For one, a large portion of its population still has limited access to traditional banking services. Crypto can fill a gap that traditional infrastructure has fallen short of, serving as a democratizing force that allows people to participate in the economy even if they have never owned a credit card.

But the unbanked are not the only segment of the Latin American populace interested in digital assets. Crypto is also a faster and cheaper way of sending and receiving money from abroad than traditional cross-border payment solutions, which often have long processing times and charge high fees. That's significant, given that the individuals who have migrated from Latin American countries form a significant diaspora, and these nations thus benefit substantially from remittances sent from abroad.

In this piece, we examine growth patterns in some of the countries making up Latin America, highlighting crypto's unique utility as a method to provide relief against national currency devaluation and inflation, corruption, and periods of economic hardship.

Colombia

Crypto began gaining traction in Colombia in the early 2010s, in line with increasing interest across the globe. Colombia’s thriving fintech sector, backed by government support, has helped foster an environment that sparked interest in cryptocurrencies. Over a decade later, this interest remains strong: across Latin America, Bakkt has the most open accounts in Colombia (as of February 2, 2024).

Given that economic instability is a concern in the country, many Colombians are drawn to crypto as a potential investment opportunity that bypasses currency devaluation and inflationary pressures. Others see it as a more affordable and efficient way of carrying out remittances and cross-border transactions.

While crypto adoption among businesses and institutions is still nascent in Colombia, there has been growing interest. Businesses have begun accepting crypto as a form of payment, and some fintech startups have explored the potential applications of blockchain technology for payments and supply chain management.

While there is much work to be done before crypto is fully regulated in the region, recent announcements have fueled optimism. In an October 2023 conference, Colombian finance minister Ricardo Bonilla announced a bill designed to regulate cryptocurrencies alongside the announcement of a plan for a Central Bank Digital Currency (CBDC).3 This bill would provide increased legal clarity for individuals and organizations operating within the cryptocurrency ecosystem and help to foster innovation by providing a conducive environment for entrepreneurs and startups in the space.

Peru

Following years of severe economic imbalances and multiple government corruptions, many Peruvians turned to crypto to hedge against inflation and political instability.4 User penetration in the country is expected to hit 14.21% by 2028, or 5.04 million users nationwide.5 While crypto is still largely unregulated in Peru, the government is taking necessary steps to increase regulation as they anticipate increased adoption.

Ecuador

As it stands, Ecuador still lacks comprehensive regulatory frameworks related to crypto. This is undoubtedly a challenge for individuals, businesses, and investors looking to participate in the market. However, the country's interest in blockchain technology continues to grow despite this, and much of the data points to an upward trend.

Mexico

Mexico issued its first crypto regulatory framework in 2018, when the government and the financial authority, CNBV, set out to clarify the use of cryptocurrencies.

Today, Mexico recognizes and permits the use of cryptocurrencies for payments and value transfer. However, they are not considered legal tender. Profit from crypto sales or exchanges in Mexico is subject to taxation.

The country's crypto exchanges fall under the regulation of the Law to Regulate Financial Technology Companies, which expands anti-money laundering (AML) regulations to crypto service providers. This law imposes diverse registration and reporting obligations on cryptocurrency service providers, suggesting a desire to integrate crypto more fully into the country’s traditional financial frameworks.

Argentina

Argentina is in the midst of extreme currency devaluation, with its peso plunging by over 50% against the U.S. dollar by the end of 2023.6 Crypto’s role becomes clear in these economic situations, as Argentina leads Latin America in crypto adoption. According to Chainalysis, as the Argentinian peso lost value, crypto purchasing trended up, eventually spiking when Argentina’s inflation crossed 100%.7

Bakkt saw the same trend from 2023 to 2024, with Argentina seeing the largest spike in new Bakkt accounts by over 200%.

Looking Forward

Over the past few years, Latin America has helped substantially to push the crypto agenda forward. El Salvador was the first country to make Bitcoin legal tender in September 2021.8 In July 2022, Honduras launched a "Bitcoin Valley" for tourism.9

In addition to the countries outlined, crypto sentiment and adoption are particularly high in Brazil. In a global survey, 73% of respondents from Brazil stated they trust crypto exchanges — higher than in the US, UK, or Australia – and only 11% of Brazilian respondents said that they would never trust a crypto exchange again.10 Furthermore, 42% of Brazilians agree that they have "increased the frequency of their engagement with crypto" since 2022.

In December 2022, the country established a legal framework for crypto payments and services to provide increased clarity for consumers, investors, and businesses utilizing crypto.

Over the next few years, there will likely be a series of new opportunities and complex challenges surrounding the future of crypto in Latin America.

Conclusion

Crypto offers many benefits to Latin America, where approximately 70% of the population is unbanked or underbanked.11 The region also relies heavily on remittances, and crypto is an efficient, cost-effective means for cross-border transactions. For many in the region, crypto is also a way to guard against currency devaluation and economic instability. As a result, an increasing number of fintech companies have sprung up over the past few years to meet these needs and drive growth in the sector.

Bakkt's growing presence in Latin America capitalizes on increased demand in the region. As it stands, the company is in several active conversations with the goal of larger activations throughout 2024.

In the years to come, Bakkt aims to improve liquidity, promote institutional adoption of crypto in the region, and ultimately contribute to developing crypto infrastructure and increasing the credibility of the crypto ecosystem in the area. The data paints a clear picture of growth opportunity within Latin America, but it’s not the only market with high potential. Stay tuned for future Crypto Current articles as we dive into other regions around the world where Bakkt is active.

Are you a neobank, investment app, or other fintech considering expanding your crypto services into Latin America? Bakkt can help.