Fast facts from Bakkt's Wave 2 Crypto Tracker

Crypto markets move quickly—and consumer sentiments naturally shift along with them. A holistic understanding of this fluidity is key for optimizing any crypto business strategy. In October last year, Bakkt’s Wave 1 Crypto Tracker delved deep into the minds of Crypto Owners and Crypto Curious individuals alike, gleaning valuable insights about their inner motivations, behaviors, and desires.

Now, the second wave of our Crypto Tracker is shedding insight on shifting consumer behaviors and attitudes. Perhaps unsurprisingly, the tides of public opinion have noticeably changed since 2022. With macroeconomic factors impacting demand, a consumer base that grows ever-more savvy, and new stakeholders entering the fold, there’s a lot to unpack.

Here are three fast facts to give you a taste of the greater findings in the report.

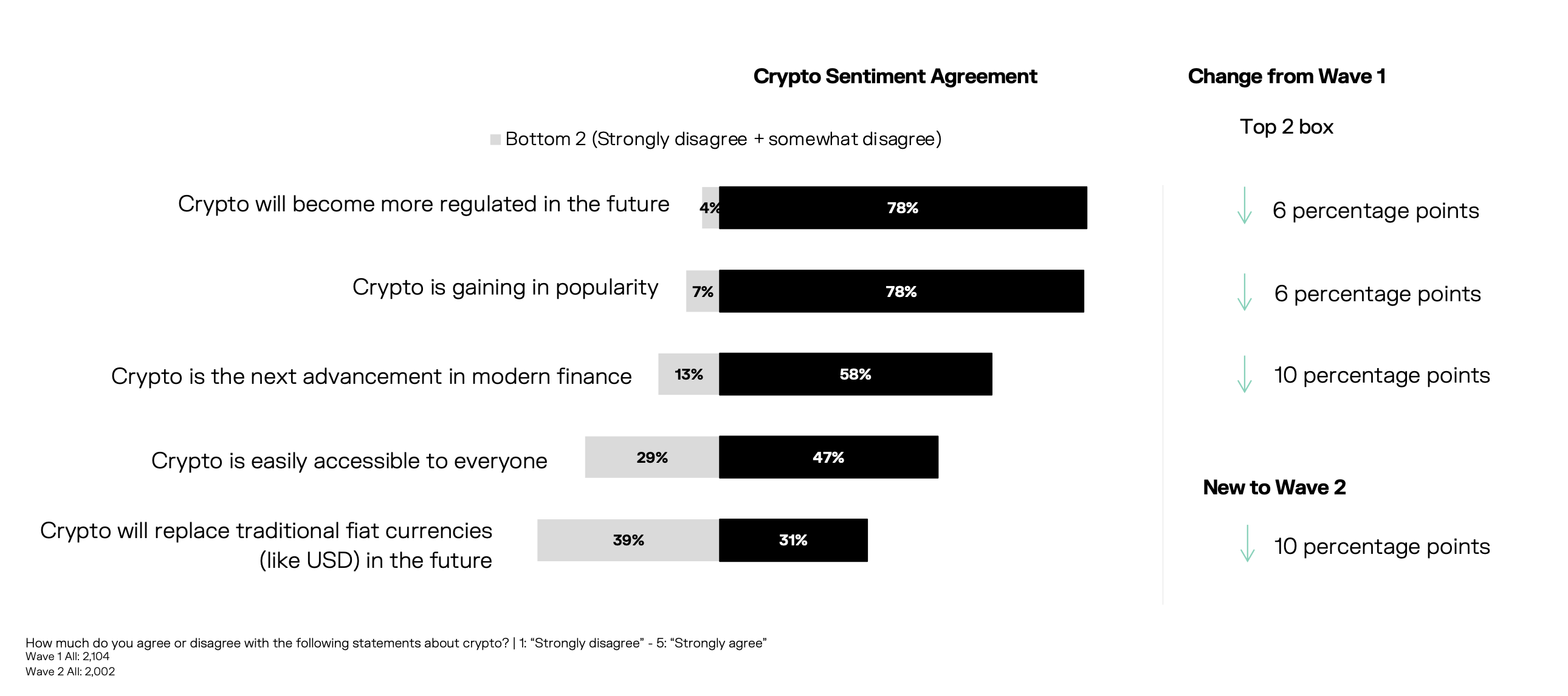

Fast fact #1: Macroeconomic impacts

Crypto news and events are not actually top of mind for consumers. Only 11% of participants had unaided recall of the FTX collapse. Macroeconomic factors remained more salient, suggesting they may play a more impactful role in discouraging the Crypto Curious.

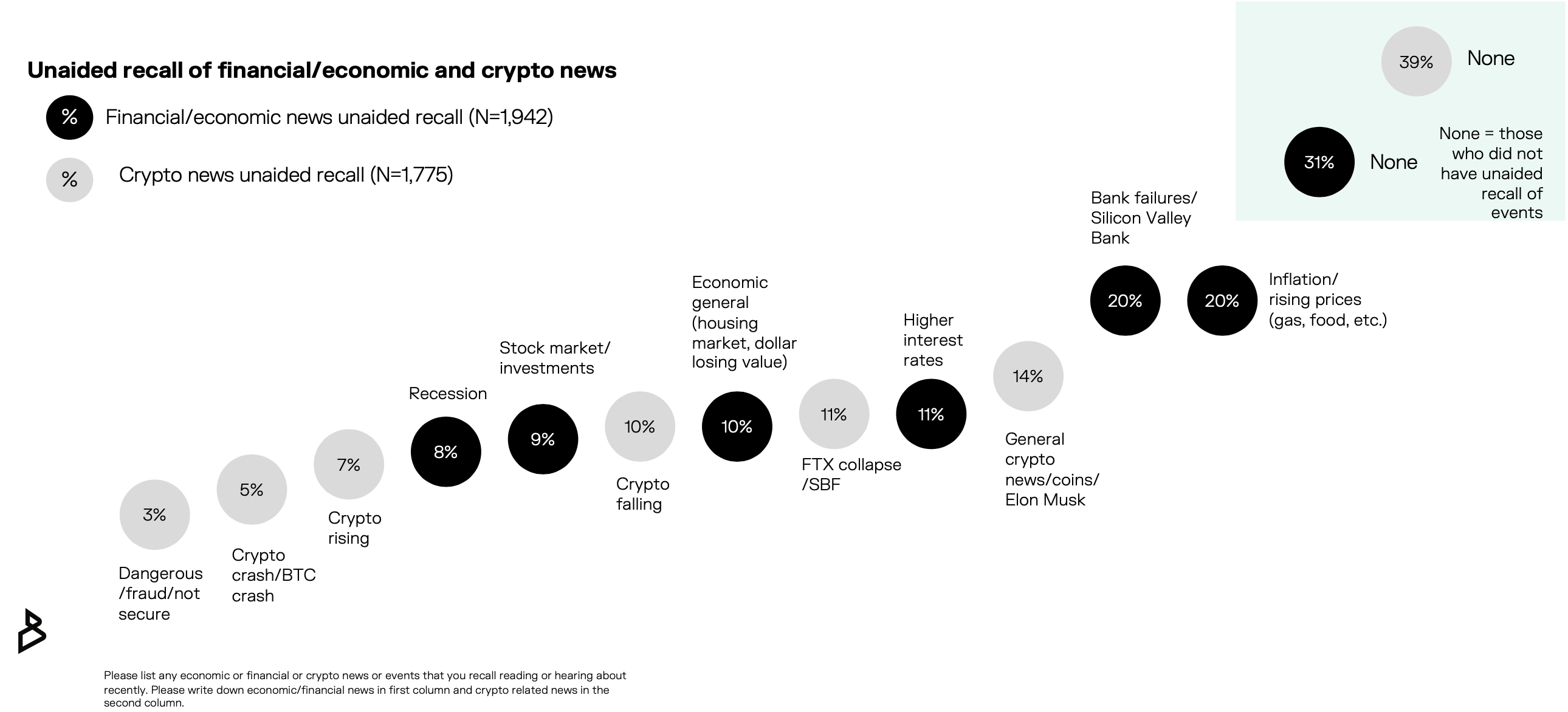

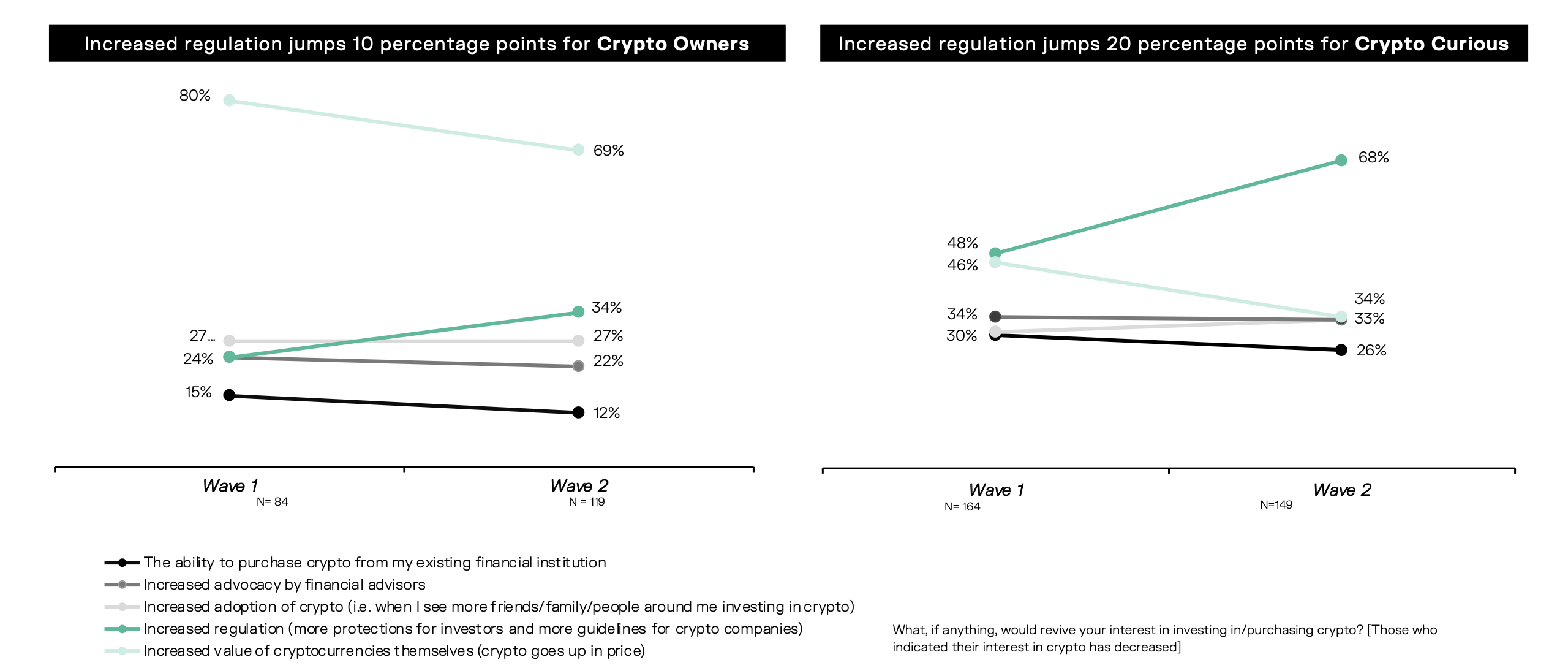

Fast fact #2: The need for regulation

Increased regulation has assumed more importance in reviving interest for both Crypto Owners (up 20 percentage points since Wave 1) and Crypto Curious (up 10 percentage points). This emphasizes the need (and desire) for a clearer and more cohesive regulatory landscape.

Fast fact #3: Building trust

Although trust is a growing barrier for new market entrants, data suggests it can be built through channels where the Crypto Curious already have existing customer relationships. 77% of them trust banks or credit unions as a venue for acquiring crypto, with 70% trusting financial advisors and nearly half trusting loyalty rewards programs.