Bakkt partners with Plaid to offer faster, seamless account linking for fiat onramps

As the cryptocurrency industry continues to mature, crypto providers must offer users ever more streamlined and sophisticated services to meet demand. Bakkt’s recent partnership with Plaid, a leader in fintech data connectivity, is pivotal in addressing what today’s crypto consumers want: a fast, seamless way to bring fiat into their crypto wallet.

Since most retail investors keep the bulk of their cash in banks and other financial institutions, efficient fiat-to-crypto onramps between banks and crypto platforms greatly improve the user experience.

The Bakkt® and Plaid layered integration allows users to easily link their bank accounts to fund crypto trading. Bakkt provides the fiat-to-crypto onramps, while Plaid takes care of the verification process needed to link end users’ bank accounts to enable transfer of fiat from their banks into their crypto wallet. Plaid also provides account linking functionality to more than 7,000 fintech apps..

Connect end users to crypto in seconds

For our clients, this means that Bakkt can securely connect end user bank accounts to clients’ front-end environments—often within seconds—and without forcing them to leave the familiar environment of the app they're using. The main benefit is speed: both for clients onboarding with Bakkt, who will be able to easily connect and authenticate their customers’ bank accounts during onboarding, and for end users, who will be able to quickly connect their Plaid-verified accounts. This simplification of the user flow and onboarding processes will increase efficiency for clients and end users alike. And for clients with preexisting Plaid relationships, the process is even faster.

Fintechs, neo-banks, and other apps looking to offer crypto access to their customers can leverage the layered integration via two easy steps:

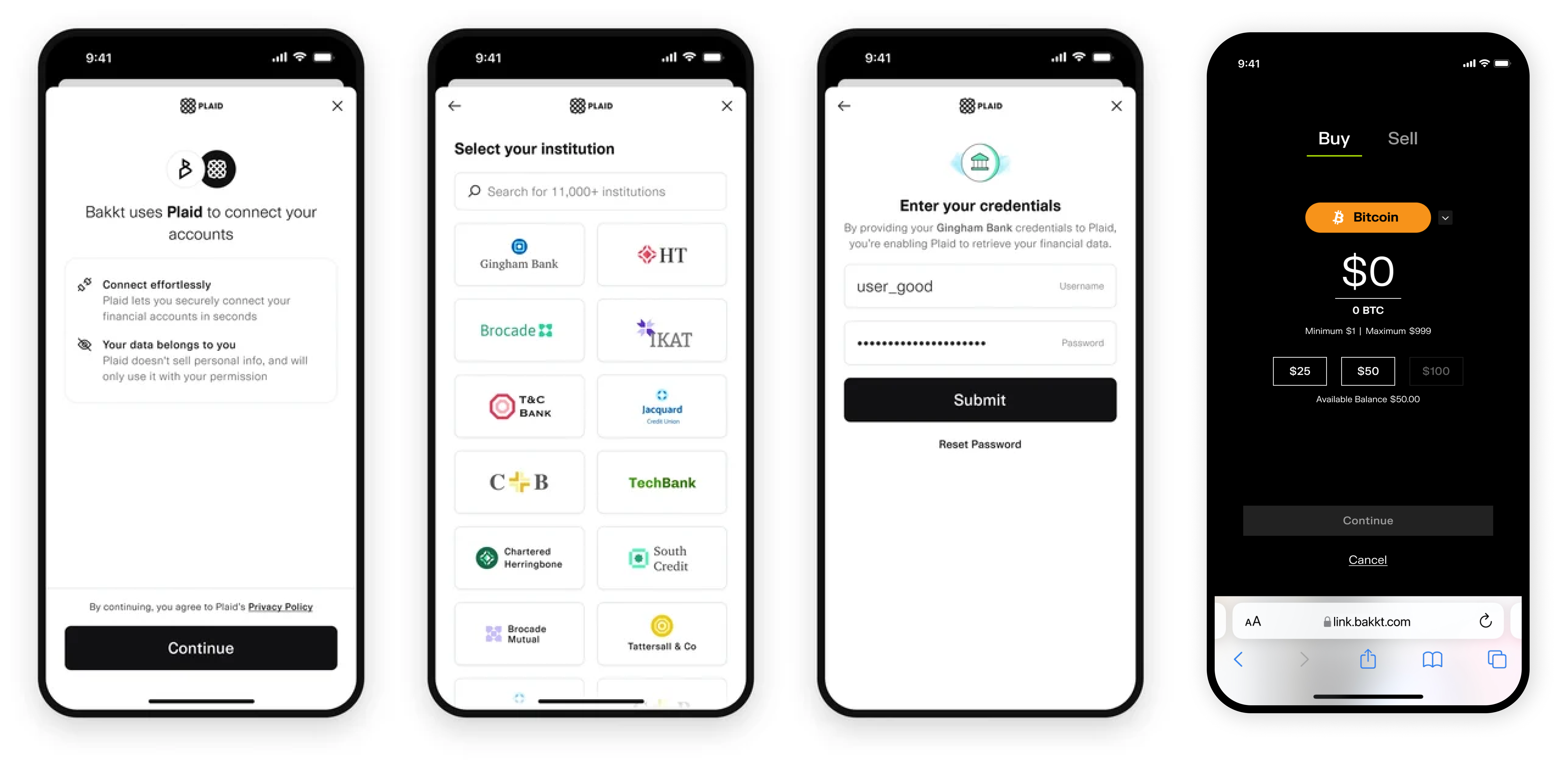

1. Connect + Authenticate Bank Accounts through Plaid LinkClients who are not yet integrated with Plaid will first embed Plaid’s drop-in UI to allow users to connect and authenticate their users’ bank accounts.

2. Use Bakkt APIs to Offer Crypto Trading in Your App

Bakkt connects to users’ authenticated bank accounts to convert fiat to crypto, and then delivers crypto trading capabilities to your users in your app or environment.

Bring onramps to your customers seamlessly and securely

Bakkt offers institutional-grade custody, trading, and onramp solutions for businesses to activate crypto strategies for their users. With a BitLicense, MSB registrations, Money Transmitter Licenses, and the ability to operate in all 50 states—plus select regions internationally—Bakkt takes care of licensing and security for a fast and seamless integration to crypto. Your customers are protected every step of the way. Many of our clients are already integrated with Plaid, streamlining operations further and allowing us to foster a B2B2C ecosystem of trust and efficiency. With user engagement and satisfaction held paramount, Bakkt intends to continue forging strong partnerships with the best of fintech to expand the crypto horizon for our clients and their customers alike.

To learn more about the integration, view our fact sheet or click below to visit our dedicated page