Qualified Custody

An NYDFS Qualified Custodian owned by

a publicly-traded crypto company, Bakkt's custody platform is built to mitigate risks for institutions.

Safeguard your digital assets with a reliable Qualified Custodian.

At Bakkt, we focus on security so that you can focus on your business.

In addition to high-grade security and operational controls, our platform offers insurance to help protect assets against potential loss, completed SOC 1 Type II reports and AML policies, and an Independent Trust Structure for mitigating regulatory risk.

Secure wallet key management

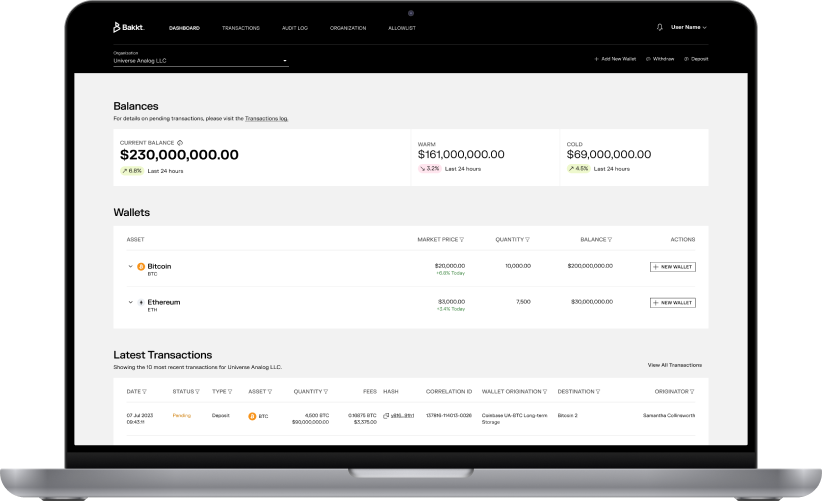

Key management with Multi-Party Computation (MPC) technology. Segregated wallets with warm and cold storage, and addresses viewable on chain.

Disaster resiliency

Geographically distributed data centers. Secondary facilities capable of supporting all production workloads.

Secure wallet key management

Key management with Multi-Party Computation (MPC) technology. Segregated wallets with warm and cold storage, and addresses viewable on chain.

Disaster resiliency

Geographically distributed data centers. Secondary facilities capable of supporting all production workloads.

FAQs